Calls and puts calculator

This simple rule doesnt work 100 of time especially for deltas very close to 050 and options with longer time to expiration. Adding editing and adjusting programs has never been.

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-02-7a6cec73fd1b4bbd877e5c61d8186b04.jpg)

Options Basics How To Pick The Right Strike Price

Using the Active Trader Pro options profit loss calculator.

:max_bytes(150000):strip_icc()/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-03-34c346d142194e909757661f6cdcd95a.jpg)

. Welcome to the most popular Covered Calls data site on the Internet. Generally Fed Calls must be met within 5 business days but Fidelity may cover the call at any time. Tax benefit 6 as per prevailing tax laws.

Update your mobile number e-mail ID with your stock brokerdepository participant and receive OTP directly from depository on your email id andor mobile number to create pledge. VSP is the only national not-for-profit vision care company. If out-of-the-money options are cheap theyre usually cheap for a reason.

Calculator Help and Information Learn More about the Covered Call. In a divorce or separation the court can grant alimony to the party seeking maintenance. Invest In MC 30.

THE FORECAST CALLS FOR RAIN BIRD. Therefore at-the-money options are likely to have relatively significant rupee losses over time than in. Delta is on a scale from 100 to -100.

Stock brokers can accept securities as margin from clients only by way of pledge in the depository system wef. This means that the OTM calls and hence ITM puts are trading with higher volatilities than normal against their at-the-money. Invest in Direct Mutual Funds New Fund Offer NFO Discover 5000 schemes.

Calls in Options Trading. Create a foundation by learning about the basics using calls picking expiration dates and more. Ensure right life cover 1 to protect yourself adequately at every life-stage 2.

For investors who want to manage their retirement portfolio while spending 10 minutes a day selling ITM puts is a reasonably good long-term strategy. To put it simply the purchase of put options allow you to sell at a strike price and the purchase call options allow you to buy at a strike price. OCC makes no representation as to the timeliness accuracy or validity of the information and this information should not be construed as a recommendation to purchase or sell a security or to provide.

Visualise the projected PL of a put option at possible stock prices over time until expiry. The second is Chapter 13 which constitutes a reorganization. The final spreadsheet does that for covered calls.

Gamma is the measurement of the rate of change of the Delta. Longer-dated expiries and puts with lower strike prices will almost always be worth more than nearer expiring options or higher-striked puts. Use the Probability Calculator to help you form an opinion on your options chances of.

Is Writing Options Profitable. MC30 is a curated basket of 30 investment-worthy. You can even upload it to Google Drive and use it on the cloud like a web application.

The Debt Payoff Calculator uses this method and in the results it orders debts from top to bottom starting with the highest interest rates first. At the money options have delta about 050 or -050 for puts. Deep-in-the-money options eventually move dollar for dollar with the underlying stock.

How a Market Fall Affects Options. If GME stays at 39 by the time the contract expires it will be worth significantly less since long calls and puts lose value as time passes known as theta or time decay. This simple risk of ruin calculator helps you determine your potential trading risk.

Profit strike price stock price - option cost time value. 333 of the payers monthly net income - 25 of the receivers monthly net income the amount paid per month. Embarking on options trading with confidence is important.

Note calls and puts have opposite delta signs. Stock Index FO Trading Calls Market Analysis. To calculate monthly alimony payments use this equation.

Theta measures the rate of decline in the price of an option due to time passing. You are agreeing to receive autodialed calls prerecorded messages andor text messages from VSP its affiliates and third parties. If it is higher than 050 it is in the money.

Commodity Trading Calls Market Analysis. Get Your Free Put Selling Calculator. Use this tool or browse our other resources to make more informed trades.

When the margin equity in the account exceeds the federal Reg T requirement of 50 the amount in excess of the requirement is referred to as the SMA. Check your strategy with Ally Invest tools. You can choose between viewing the profit and loss in dollars or percent as well as viewing the actual value of the contract by clicking the buttons below the table.

Options Basics Menu Toggle. Focus on People not Profit. The PROGRAMS page gives you an overview of all of your programs and program details.

Accidental death benefit 5 cover up to 2 crore optional. Second and in October 1987 this proved to be far more important option prices increase because frightened investors were anxious to own put options to protect the assets in their portfoliosso much so that they did not care or understand how to price options. Want to manage your programs.

Go ahead click it. The Covered Call Strategy. We have been in the Covered Calls data business since 1997 and are one of the original options data vendors on the web.

Use the Profit Loss Calculator to establish break-even points evaluate how your strategy might change as expiration approaches and analyze the Option Greeks. First the market falls making the puts more valuable. Debt management can offer relief from constant calls emails and letters from creditors.

Put option profit calculator. Therefore if the absolute value of an options delta is lower than 050 the option is out of the money. The Most Basic Options.

Married Puts loss guaranteed less than 5 even if stock drops to zero CC Hedge-fund create a self-protecting investment vehicle with the QLDQID. The Quick Access toolbar puts your most common activities just one click away. Get claim payout on diagnosis of 64 critical illnesses 4 optional.

Although this is an Excel xlsx file it can be opened and used on most spreadsheet programs including free ones like Open Office. Find high and low volatilty options for QQQ and other multi-leg option positions for stocks indexes and ETFs. Track your portfolio 24X7.

This puts the filer on a payment plan. Theta is also known as. If the Reg T initial requirement is not met a Fed Call is issued against the account.

Cash covered puts and other more advanced strategies to help you in a neutral market. Theta is the amount the price of calls and puts will decrease for a one-day change in the time to expiration. The covered call calculator and 20 minute delayed options quotes are provided by IVolatility and NOT BY OCC.

Technical Call Trading Calls Insights. Get 105 of your premium back 3 or get monthly income from age 60 on survivalmaturity. Platform-Independent and 100 Unlocked.

Use the alimony calculator below to estimate your spousal maintenance in Illinois. Using the key. When you choose VSP you can be confident youre choosing a company that puts your vision care needs first.

Using The Free Trade Calculator To Profit On Call And Put Spreads Option Party

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Theta Varsity By Zerodha

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

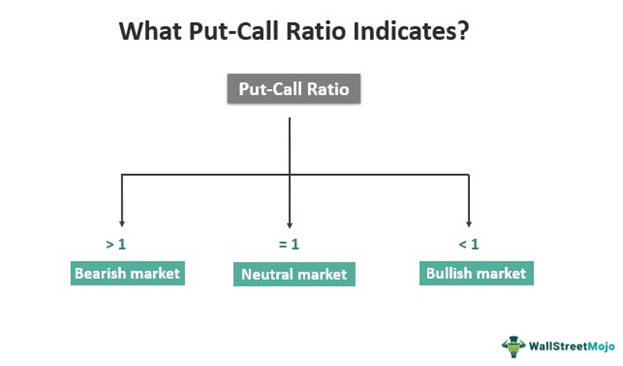

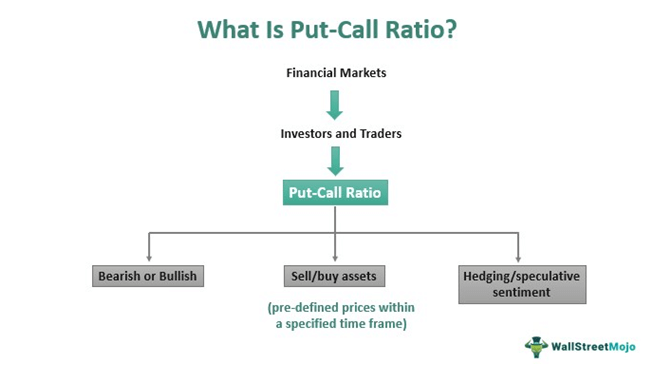

Put Call Ratio Meaning Example Indicator Trading Strategy

Put Call Ratio Meaning Example Indicator Trading Strategy

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-03-34c346d142194e909757661f6cdcd95a.jpg)

Vertical Spread Definition

Future Calculator Dividend Stocks Option Strategy Buy Sell Different Strike Earthlink Technologies

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Summarizing Call Put Options Varsity By Zerodha

Call Option Calculator Put Option

Summarizing Call Put Options Varsity By Zerodha

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Summarizing Call Put Options Varsity By Zerodha